The reason why the comparable model can be used in almost all circumstances is due to the vast number of multiples that can be utilized, such as the price-to-earnings (P/E), price-to-book (P/B), price-to-sales (P/S), price-to-cash flow (P/CF), and many others. Still, instead, it compares the stock's price multiples to a benchmark or nearest competition to determine if the stock is relatively undervalued or overvalued. This model doesn't attempt to find an intrinsic value for Blue Apron's Stock. Comparative valuation analysis is a catch-all model that can be used if you cannot value Blue Apron by discounting back its dividends or cash flows. Also, Tangible Asset Value is likely to grow to about 205.6 M. As of 4th of June 2023, Average Assets is likely to grow to about 225.3 M. It is rated third in net asset category among related companies making up about 174,759,522 of Net Asset per Price to Book. You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself.Blue Apron Holdings is number one stock in price to book category among related companies. Simply Wall St has no position in any stocks mentioned. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

We aim to bring you long-term focused analysis driven by fundamental data. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice.

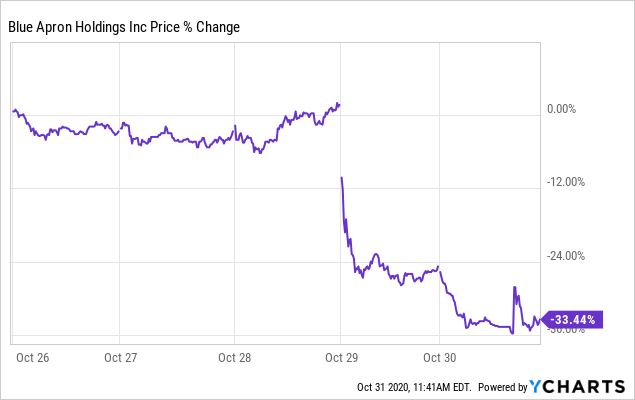

This article by Simply Wall St is general in nature. Alternatively, email editorial-team (at). Have feedback on this article? Concerned about the content? Get in touch with us directly. The company's shares are down 31% from a week ago.īefore we wrap up, we've discovered 5 warning signs for Blue Apron Holdings (1 is significant!) that you should be aware of. Performance of the American Consumer Retailing industry. on average during the next 3 years, compared to a 4.1% growth forecast for the Consumer Retailing industry in the US. Looking ahead, revenue is forecast to grow 14% p.a. Earnings per share (EPS) missed analyst estimates by 40%.

Revenue was in line with analyst estimates. Blue Apron Holdings EPS Misses Expectations

0 kommentar(er)

0 kommentar(er)